Schedule a Meeting With Tripp Limehouse or Call 803-359-2569

“Third-Party Posts”

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Limehouse Financial, deems reliable but in no way does Limehouse Financial guarantee its accuracy or completeness. Limehouse Financial had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Limehouse Financial. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Limehouse Financial, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

6 Ways to Secure Your Finances After Retirement

Although your CalPERS service retirement is a lifetime benefit, and you have other income sources available to you, money can still be tight. Making ends meet is a big concern for many retirees. Here are six tips for saving money during retirement, as part of our...

Retirement planning with annuities in 2025: Key considerations and trends

Annuities have seen a resurgence in popularity as a retirement planning tool, especially in 2025, driven by market volatility, higher interest rates, and an aging population seeking stable income streams. Here's what you need to know about retirement planning with...

7 steps to prepare for your upcoming retirement

Planning to retire within the next 10 years? Taking these actions now could help bolster your portfolio as you approach your planned retirement date. After decades of working and saving, you can finally see retirement on the horizon. But now isn't the time to coast....

Getting Ready for Retirement Checklist

If the word “retire” is becoming your new mantra, we suggest you make a retirement checklist before you receive your last paycheck. It’s never too early (or too late) to start planning your retirement. So why not start now, using the handy checklist below. 10 Steps...

The Most Important Ages of Retirement

Retirement is a series of milestones that arrive as you age. Here are the ones you should know about. The retirement clock doesn't start the day you stop working. It's better to think of this period of your life as a range of important dates and milestones spread...

Social Security Benefits Changes in 2025: What You Need to Know for Smarter Retirement and Tax Planning

Social Security is one of the most essential yet misunderstood pieces of the American retirement puzzle. With all the recent headlines, ranging from benefit increases and new payment rules to potential tax reforms under the Trump administration, many retirees and...

Planning to retire in 2025? Do these 7 things now

A wonderful retirement is the goal of many people, and you want it to come off without any major snags. But retirement plans always face challenges, whether it’s the volatility of the markets, the affordability of healthcare or the risks posed by inflation. Plus,...

3 Retirement Mistakes That Can Still Be Fixed in 2025

Retirement planning is rarely perfect. Life throws curveballs—health issues, market downturns, career changes—and even the most diligent savers can stumble along the way. If you’ve made financial missteps or feel unprepared as you approach retirement, you’re not...

8 Ways to Keep From Going Broke in Retirement

Budgeting, saving and investing tips to help make your money last as long as you do No matter how diligently you’ve been saving for retirement, it’s hard not to worry about outliving your money. But you can take several steps to contain your expenses, manage your nest...

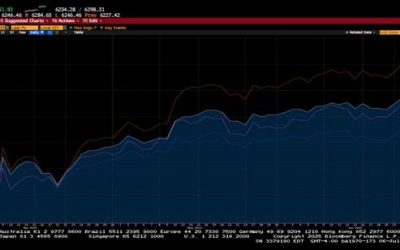

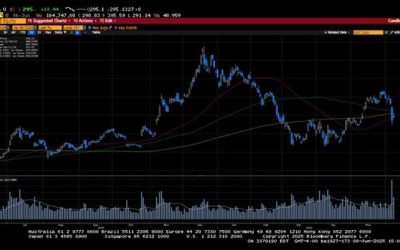

Weekly Market Commentary

Markets forged another set of all-time highs before taking a step back last week as a deluge of information had to be digested by investors. August 1st was the tariff deadline, and while some deals were made ahead of the deadline, several other countries had their...

Weekly Market Commentary

The S&P 500 and NASDAQ reached another set of all-time highs, driven by constructive rhetoric on global trade and positive second-quarter earnings results from influential companies such as Alphabet. The S&P is up 8.6% year to date, while the NASDAQ is up...

Weekly Market Commentary

U.S. equity markets were little changed for the week; that said, the S&P 500 and NASDAQ were able to forge another set of all-time highs. A busy Q2 earnings calendar saw 12% of the S&P 500 report earnings. Earnings from several large banks came in better than...

Weekly Market Commentary

A barrage of tariff letters sent to over 20 countries by President Trump yielded very little movement in the financial markets. Trump announced that there would not be additional extensions to negotiations and that tariff levels sent in these letters would go into...

Weekly Market Commentary

The holiday-shortened week produced another week of gains for US equity indices. The S&P 500 was up 10.6 % in the 2nd quarter, while the NASDAQ composite rose 17.8%. Trump’s reconciliation bill was passed by the Senate and subsequently approved by the House,...

Weekly Market Commentary

The S&P 500 and the NASDAQ joined the NASDAQ 100 in forging new all-time highs in an extremely busy week for Wall Street. A de-escalation of the Iran-Israel-US conflict happened on the twelfth day after Israel's initial strikes. The US bombed three key nuclear...

Weekly Market Commentary

Despite there being plenty for investors to consider, the holiday-shortened week ended pretty much where it started. Israel and Iran continued to exchange missile attacks, while global leaders tried to find a resolution to the conflict. President Trump opened the door...

Weekly Market Commentary

US markets advanced in an erratic week of trading. The S&P 500 ended the week above the 6000 level and is up nearly 24% from the April 7th lows. Investors continue monitoring global trade policy, hoping more trade deals will be signed soon. Trump acknowledged...

Weekly Market Commentary

-Darren Leavitt, CFA The holiday-shortened week was busy. Trade uncertainties continued to be on investors' minds, with several trade stories hitting the tape throughout the week. News on Tuesday that President Trump had extended the timeline for negotiations with...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Limehouse Financial) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Limehouse Financial.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

IRS Addresses Unanswered Questions About Trump Accounts

Ian Berger, JD IRA Analyst As is often the case with new legislation, the One Big Beautiful Bill Act (OBBBA) left unanswered a number of questions about Trump Accounts, the new savings vehicle for children. Some of those questions were discussed in a Slott...

First-Time Required Minimum Distributions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: My client turns age 73 in November 2026. If he takes his first required minimum distribution (RMD) in December 2026 rather than waiting until April 1, 2027, what balance is used to do the RMD calculation? Thanks...

New IRS Guidance on Trump Accounts Is Released

Sarah Brenner, JD Director of Retirement Education The IRS has issued guidance on Trump Accounts, which are new tax advantaged accounts for children established as part of the One Big Beautiful Bill Act (OBBBA). Trump Accounts are scheduled to become available...

Yes, RMDs Apply to Inherited Roth IRAs, But…

By Andy Ives, CFP®, AIF® IRA Analyst We have written about this topic in The Slott Report before (“Inherited Roth IRA: RMDs or No?” – May 15, 2023), yet the questions continue to roll in. Yes, required minimum distributions (RMDs). DO APPLY to inherited Roth...

Stretch RMDs and Roth Conversions: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: Hello Ed, I have been a fan of yours for a long time (and the owner of a copy of The Retirement Savings Time Bomb) and have always appreciated your insights. We have a client who is age 58 years and is the sole beneficiary of a...

The Crazy-Complicated 2026 SIMPLE IRA Plan Elective Deferral Limits

Ian Berger, JD IRA Analyst Since 2002, SIMPLE IRA plans have allowed employees who reach age 50 or older by the end of the year to make “catch-up contributions” beyond the usual elective deferral limit. Beginning in 2024, Congress automatically increased the regular...

Who Needs to Take a 2025 RMD?

By Sarah Brenner, JD Director of Retirement Education As the calendar runs out on 2025, retirement account owners and beneficiaries may face a looming deadline. December 31 is the deadline for many to take 2025 required minimum distributions (RMDs). Test your...

The Slott Report Gives Thanks

By Andy Ives, CFP®, AIF® IRA Analyst Thanksgiving Season is upon us! Here at The Slott Report, we are thankful for many things: We are thankful to have a platform to share all the important IRA and retirement account information about which we write. We are thankful...

IRA and Retirement Plan Dollar Limits Increased for 2026

By Ian Berger, JD IRA Analyst The IRS has released the cost-of-living adjustments (COLAs) for retirement accounts for 2026, and many of the dollar limits will increase next year. Retirement Plans The elective deferral limit for employees who participate in 401(k),...

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Limehouse Financial, deems reliable but in no way does Limehouse Financial guarantee its accuracy or completeness. Limehouse Financial had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Limehouse Financial. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Limehouse Financial, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

Colorectal cancer screenings can save your life

Get a colorectal cancer screening at no extra cost to you. Learn more about life-saving screening options. Have you been putting off your colorectal cancer screening? It may not be the top of your to-do list, but regular screening tests can save lives. Colorectal...

read more

Get the care you need quickly when you’re sick

Discover six ways to access care fast, even if your doctor is busy. Hint: You may not need to go in person. Doctors’ offices are busier than ever these days. Sometimes it can be tough to book a timely appointment with your primary care provider. You might be sick or...

read more

Can You Apply for Medicare Without Social Security?

Key Points You do not need to be receiving Social Security benefits to apply for Medicare. You can receive Social Security benefits as early as 62 and Medicare benefits at 65. If you are already receiving Social Security benefits before your 65th birthday, you’ll be...

read more

Is the Medicare Annual Wellness Visit Mandatory?

Key Points While the Medicare Annual Wellness Visit is not mandatory, it is a 100% covered preventive service. The Annual Wellness Visit differs from the typical annual physicals you were used to with group coverage. If you’ve had Medicare Part B for more than 12...

read more

Why You Need Part D

Key Points Medicare Part D is a voluntary program, but if you do not enroll in a plan, you won’t have coverage for expensive medications. You will also have a late enrollment penalty if you don’t have other creditable coverage. Medicare Part D is a huge time...

read more

Medigaps

Original Medicare Part B covers 80% of the cost of most services. But what about the other 20%? Or the other out-of-pocket costs like deductibles or inpatient copays? Let’s discuss Medigaps, which can help cover these costs. What are Medigaps? Medigaps are health...

read more

Medicare’s 2025 Surprise: Higher Costs, New Caps, and Vanishing Perks

Big changes are coming to Medicare and Social Security in 2025, and if you’re on Medicare—or soon will be—you need to know how these updates could impact your costs and coverage. Financial Sense’s Jim Puplava recently spoke with Medicare expert Brian McArthur to get...

read more

Here’s How Much Medicare Will Cost in 2025

Medicare pays for a bulk of older Americans’ health care costs, but not all. And each year Medicare adjusts key costs that are paid by enrollees. I want to walk through Medicare out-of-pocket costs for 2025. I sure hope those of you who are not yet 65 pay close...

read more

What If My Medicare Doctor “Opts Out”?

Finding a doctor you like and trust can be a long process, so I understand that it can be frustrating when your doctor no longer accepts Medicare. If your doctor has “opted out” of Medicare, this means that he or she no longer accepts Medicare assignment...

read more

Colorectal cancer screenings can save your life

Get a colorectal cancer screening at no extra cost to you. Learn more about life-saving screening options. Have you been putting off your colorectal cancer screening? It may not be the top of your to-do list, but regular screening tests can save lives. Colorectal...

Get the care you need quickly when you’re sick

Discover six ways to access care fast, even if your doctor is busy. Hint: You may not need to go in person. Doctors’ offices are busier than ever these days. Sometimes it can be tough to book a timely appointment with your primary care provider. You might be sick or...

Can You Apply for Medicare Without Social Security?

Key Points You do not need to be receiving Social Security benefits to apply for Medicare. You can receive Social Security benefits as early as 62 and Medicare benefits at 65. If you are already receiving Social Security benefits before your 65th birthday, you’ll be...

Is the Medicare Annual Wellness Visit Mandatory?

Key Points While the Medicare Annual Wellness Visit is not mandatory, it is a 100% covered preventive service. The Annual Wellness Visit differs from the typical annual physicals you were used to with group coverage. If you’ve had Medicare Part B for more than 12...

Why You Need Part D

Key Points Medicare Part D is a voluntary program, but if you do not enroll in a plan, you won’t have coverage for expensive medications. You will also have a late enrollment penalty if you don’t have other creditable coverage. Medicare Part D is a huge time...

Medigaps

Original Medicare Part B covers 80% of the cost of most services. But what about the other 20%? Or the other out-of-pocket costs like deductibles or inpatient copays? Let’s discuss Medigaps, which can help cover these costs. What are Medigaps? Medigaps are health...

Medicare’s 2025 Surprise: Higher Costs, New Caps, and Vanishing Perks

Big changes are coming to Medicare and Social Security in 2025, and if you’re on Medicare—or soon will be—you need to know how these updates could impact your costs and coverage. Financial Sense’s Jim Puplava recently spoke with Medicare expert Brian McArthur to get...

Here’s How Much Medicare Will Cost in 2025

Medicare pays for a bulk of older Americans’ health care costs, but not all. And each year Medicare adjusts key costs that are paid by enrollees. I want to walk through Medicare out-of-pocket costs for 2025. I sure hope those of you who are not yet 65 pay close...

What If My Medicare Doctor “Opts Out”?

Finding a doctor you like and trust can be a long process, so I understand that it can be frustrating when your doctor no longer accepts Medicare. If your doctor has “opted out” of Medicare, this means that he or she no longer accepts Medicare assignment...